- This story was delivered to Insider Intelligence Fintech Briefing subscribers earlier this morning.

- Insider Intelligence publishes hundreds of insights, charts, and forecasts on the Fintech industry with the Fintech Briefing. You can learn more about subscribing here.

Metro Bank is currently discussing the possible acquisition of RateSetter, according to Sky News. Although there’s no guarantee at this stage that the purchase will proceed, the existing talks support our expectation that a number of P2P lenders will be looking for buyers amid a spike in investor withdrawal requests and the ensuing shortage of loan supply, as well as an increase in delinquencies and risk of defaults among both retail and SMB lenders. This will enable large financial companies to make acquisitions on the cheap: One insider to the talks reported that the challenger bank expects to purchase RateSetter at “a knockdown valuation.”

The purchase would enhance Metro Bank’s loan distribution capabilities for unsecured consumer lending, enabling it to capitalize on future growth potential once the P2P lending sector recovers.

- This isn’t the first time the challenger bank has explored unsecured loans. It partnered with UK P2P lender Zopa in 2015 to lend funds through its platform. However, two years later, the bank scaled back this line of business due to lack of profitability. This next potential leap into the sector could be due to its stated strategy in its 2019 full-year results to “rebalance its lending mix toward areas such as unsecured loans” amid a challenging 2019 financial performance, combined with the opportunity to acquire an established player’s lending channel at a low cost. The decision also could’ve been spurred on by other challenger banks recently moving into the P2P lending space, such as Starling Bank funding loans through Zopa.

- The new deal could prove lucrative in the long run, offsetting Metro Bank’s current difficulties. Unsecured loans would generate greater interest income because they have higher interest rates than other types. This new revenue stream would come at a time when the bank is dealing with significant losses of £130.8 million ($164.6 million) in 2019, compared with £40.6 million ($51.1 million) in profit for 2018, in addition to a scandal of misclassifying loans and the ensuing regulatory investigations. It has also faced economic uncertainty because of Brexit and interest rates reaching an all-time low, further squeezing profits from traditional loans and mortgages.

As for RateSetter, it was likely able to attract Metro Bank to the negotiating table because of the steps it has taken to mitigate its losses, with the potential purchase providing the much-needed cash for the fintech to ride out the rest of the economic crisis.

- The P2P lender has implemented a whole host of measures to hinder pandemic-related losses. As we previously reported, RateSetter has been looking for a deal or a fundraising opportunity for a number of months. To present itself as a worthwhile investment, the P2P lender has taken steps to mitigate its pandemic-induced downturn: It announced a temporary 50% reduction in interest for its investors, for example. The saved interest will go to its Provision Fund, which provides a buffer for investors when borrowers miss payments, increasing protection against credit losses.

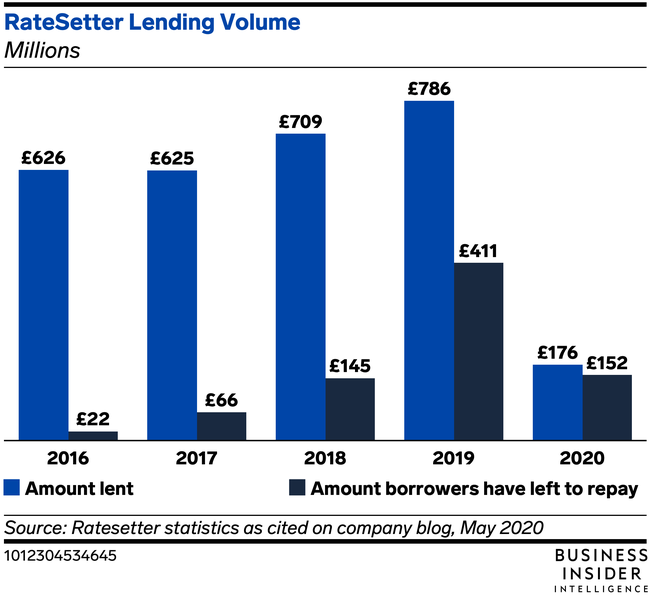

- The purchase would enable it to remain operational amid harsh market conditions. Metro Bank would provide it with welcome relief from current cash flow shortages. The growing risk of loan defaults among borrowers coupled with investor wariness has caused a steep drop in amounts lent out on the P2P lender’s platform, from £786 million ($989 million) in 2019 to £176 million ($221 million) so far this year, hurting revenue. In addition to the cash injection, the purchase would also bring in Metro Bank as a large investor on the platform, at a time when attracting investor funds is becoming more difficult. This would place RateSetter in a stronger position to ride out the economic storm caused by the pandemic and emerge fully operational.

Want to read more stories like this one? Here’s how you can gain access:

- Join other Insider Intelligence clients who receive this Briefing, along with other Fintech forecasts, briefings, charts, and research reports to their inboxes each day. >> Become a Client

- Explore related topics more in depth. >> Browse Our Coverage

Are you a current Insider Intelligence client? Log in here.